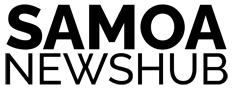

The official data provided suggests that New Zealand is currently in a recession. Stats NZ shows that the country’s economy has contracted over two consecutive quarters. In the first quarter of this year, the GDP fell by 0.1 percent, following a decline of 0.7 percent at the end of the previous year.

Although the decrease in GDP for the first quarter may seem small, there are other indicators indicating a longer period of economic contraction. The last time New Zealand experienced two consecutive quarters of negative growth, the country was in the early stages of the COVID-19 pandemic, with closed international borders and strict lockdown measures. However, the current situation differs as many households are facing financial difficulties and cannot afford to spend money.

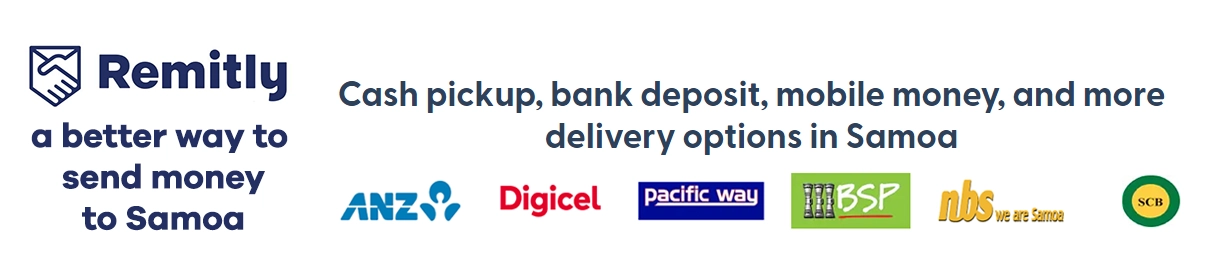

The International Monetary Fund (IMF) stated that New Zealand’s economy is undergoing a necessary slowdown after the strong recovery from the pandemic. The IMF expects the slowdown to continue due to monetary tightening measures. Both New Zealand and Australia initially benefited from government stimulus during the pandemic, but this came at the cost of overheating in the New Zealand economy, according to the IMF.

The Reserve Bank of New Zealand (RBNZ) has been raising interest rates aggressively in an attempt to control inflation. In contrast, the Reserve Bank of Australia (RBA) has taken a more gradual approach. While wage growth in New Zealand has helped households manage higher interest rates, consumers are adjusting their spending due to the increased cost of living.

Image: ABC/RBNZ, RBA

The data also suggests that retail spending and private consumption in New Zealand have been declining, which is impacting businesses. Company arrears are increasing, indicating that businesses are not receiving sufficient cash flow to survive. The New Zealand property market is showing signs of stabilisation, while the mortgage market is experiencing reduced demand.

Overall, the data indicates that New Zealand is facing economic challenges, including inflation, reduced consumer spending, and businesses struggling with arrears. The country is currently in a period of economic contraction, and the outlook suggests a slowdown in GDP growth for the foreseeable future.